As the application scenarios of digital payments continue to expand and deepen, payment methods and tools are constantly evolving and innovating. MuRong Digital Payment is a application platform for rapid deployment targeted at banks, payment institutions, and FinTech. It provides convenient and secure payment solutions, excellent merchant services, and covers scenarios from small and micro businesses to enterprise applications, allowing technological progress to truly benefit various industries and different groups of people.

How It Works ?

Mr.Bank makes the Centralized Online Real-time Exchange come true

Unify

Unify all payment types into a single

payments ecosystem

Deploy

Quickly and automatically deploy

applications in batch to server cluster.

Integrate

Easily connect to cooperative

banks,third-party payment providers,and

Fin

Techs.

Manage

Define and change workflows and business rules.

Monitor

Support unified monitoring of cross

platform terminals.

Innovate

Bring new payments products onboard quickly.

Advanced

architecture

Based on microservices architecture, it builds a distributed unified payment and clearing platform suitable for cloud+ on-premise, and adapts to the information and innovation ecology.

Product

specifications

Provides unified standardized access, unified reconciliation and settlement processing, unified risk management, and unified parameter configuration management.

Practical

experience

Successfully running on multiple large financial business systems with transaction volumes of tens of millions. Fully validate reliability, flexibility, stability, and elastic scalability.

Continuous

innovation

Focusing on the continuous research and development, optimization and innovation of financial technology platforms for many years, keeping up with the pace of market development.

Features

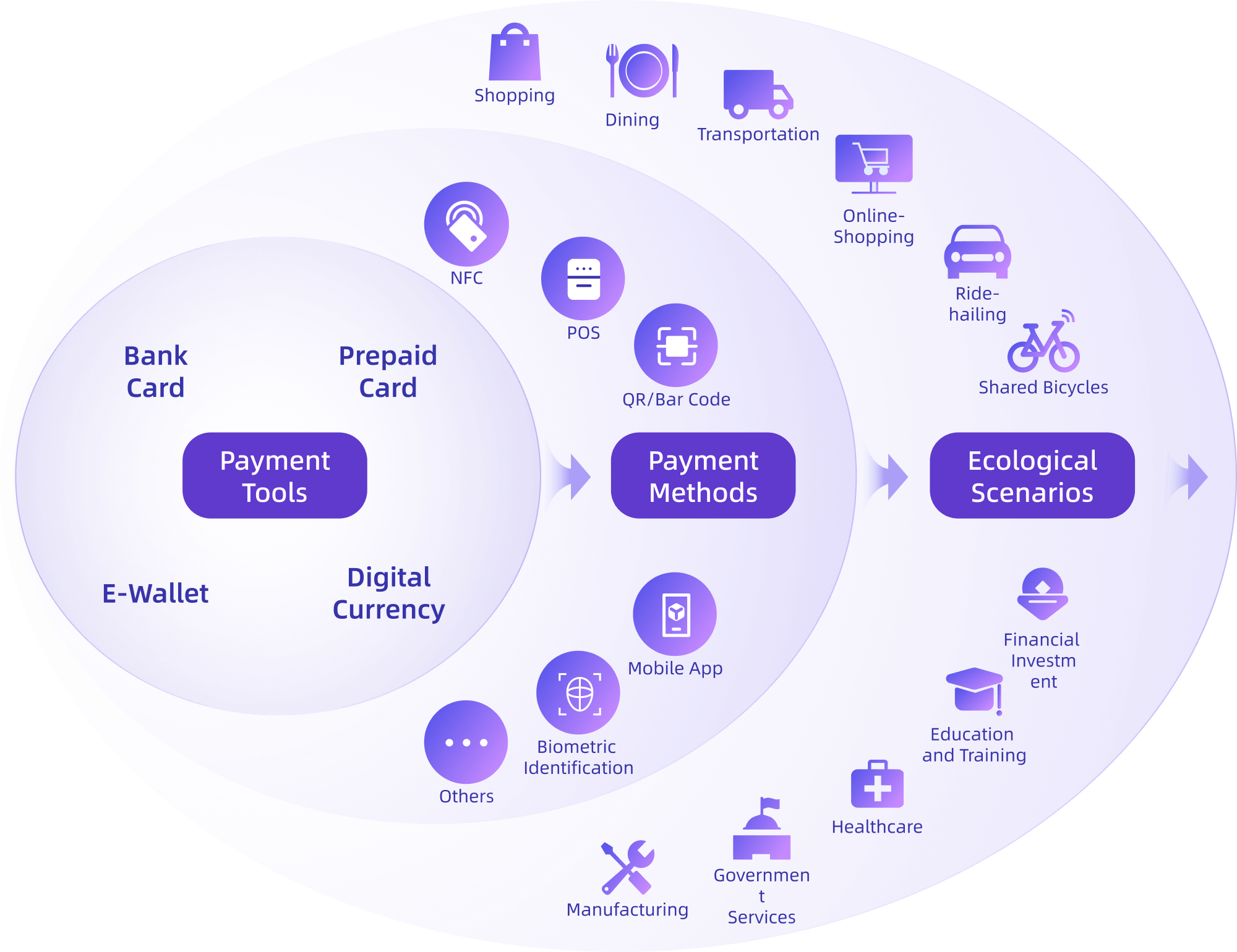

Payment Tools

Supports E-Wallet,bank card,prepaid card and other types of payment.

Payment Methods

Provides customers with rich payment methods, such as QR code, NFC, biometric payments, online banking, third-party platform, super apps.

Reliability

End-to-end security mechanism, biometric authentication, multi-factor verification, and a comprehensive flexible risk control system provide customers with a reliable digital payment experience.

Easy Access and Customization

Provides standardized access channels to quickly integrate payment business. Offers customized payment solutions tailored to different industries and scenarios, meeting the diverse business needs.

Intelligent Marketing Support

Effortlessly embedded into leading super apps to provide personalized recommendation capabilities and comprehensive marketing tools.

Comprehensive Payment Connectivity

Integrates with major international card payment networks such as VMADJ. Enables cross-border transactions and global payment acceptance. Ensures compliance with industry standards and regulations.

Open Technical Architecture

Cloud-native architecture design, supports both on-premises and SaaS deployment models. Microservices-based approach and integrating open-source databases, to meet diverse business needs.

Benefits BENEFITS

Powering Business Expansion

Wide range of payment tools and methods supports a full spectrum of payment instruments and modalities to seamlessly cater to diverse market demands. Flexible configuration options provide multiple settlement and revenue-sharing arrangements to meet the requirements of merchants. Seamless integration embedded within leading Super Apps to boost merchant traffic and stickiness.

Operational Efficiency

Automated reconciliation, error handling, risk control, customer analysis, and AI-enhanced customer service allow you to focus on core activities and achieve a more agile and efficient operation.

Reduced Complexity and Cost

Flexible deployment options lower upfront costs for merchants. Flexible configuration of functional modules helps merchants avoid redundant or unnecessary features and reduce licensing fees and maintenance costs, further optimizing the total cost of ownership for merchants.

Exceptional Customer Experience

Users can make payments anytime, anywhere using their preferred devices, payments are processed in real-time. Brings a more convenient and efficient error handling experience to the sellers.

Want To Get Started?

Get In Touch Or Download Our Brochure.